The customer experience gap refers to the difference between the level of personalization that today’s always-on, connected customers expect vs. the experience that brands actually deliver. Recognizing that customer experience (CX) is a competitive differentiator, brands across retail, travel, financial services, healthcare, hospitality and other industries are focused on narrowing the gap, although there is work to be done.

Marketers rated themselves roughly 2X higher than consumers on their ability to deliver a satisfactory CX in a Harris Poll survey that measured the gap across four dimensions: customer understanding, personalization, consistency, and privacy. What consumers indicate that most brands lack is the ability to recognize them as the same person across channels, with predictably adverse effects on each of the four CX dimensions.

The primary reason for this failure is that despite recognizing CX as a competitive differentiator, brands are still siloed in some way, shape or form – set up operationally around products or services, channels, and/or functions. The underlying customer data, technology, processes and teams are organized independently of what is best for the customer.

Despite sitting on vast amounts of first-party customer data, companies struggle to deliver relevant, individualized CX because data are accessed and actioned unevenly across those various siloes, preventing the single customer view that is necessary for consistent personalization. Many brands have a single view at some level, but it is lacking in the accuracy, completeness and/or timeliness required to drive the types of experiences consumers expect.

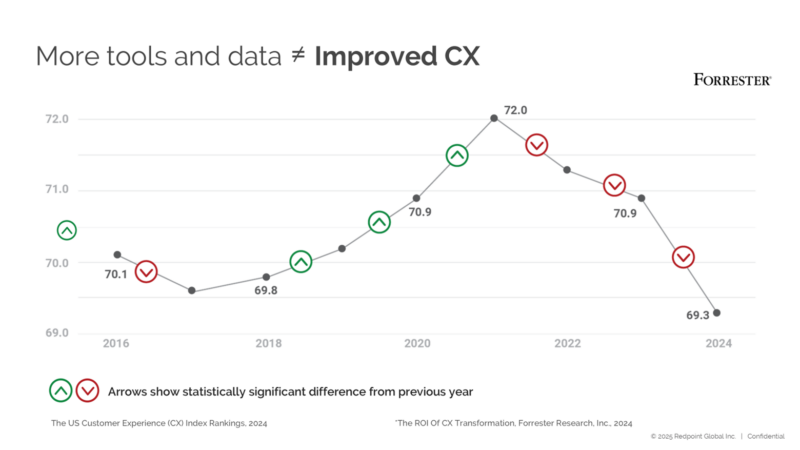

This gap is reflected in the declining CX Index, Forrester’s measure of the quality of the customer experience, connecting quality to loyalty and revenue. (See Figure 1)

Figure 1: The Forrester CX Index – the ROI of CX Transformation

It is an overall measure of how well brands deliver customer experience – which has been declining for three years in a row, reaching a nine-year low in 2024. Forrester cited two key drivers for the decline:

- An inability of brands to provide a seamless customer experience, and

- An underwhelming digital experience.

The root in both of these cases is customer data. Brands simply do not understand their customers at the depth these customers expect.

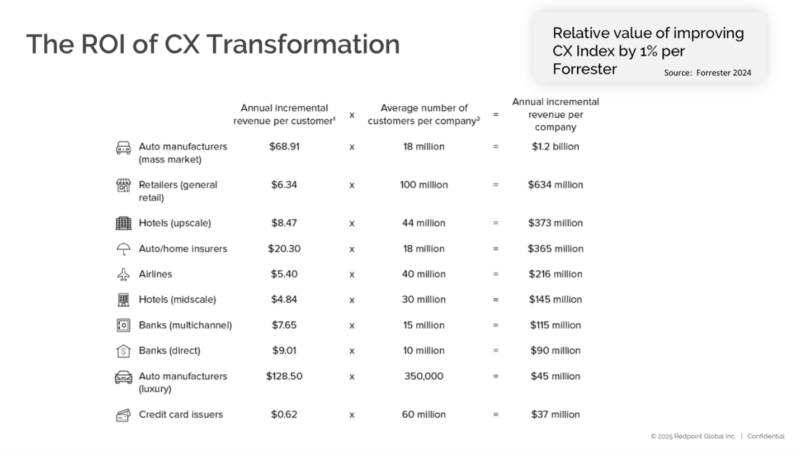

The good news is this does create opportunities for brands that can capitalize on this opportunity to extract more value from their customer data. Brands can earn 10’s or even 100’s of millions in incremental revenue for every 1 percent gain in the CX index. (See Figure 2)

Figure 2: Potential monetary gains across industry verticals for every 1 percent improvement in the CX Index. This series will highlight these types of gains from customers using Redpoint customer data technology.

Data-Centricity Leads to Customer-Centricity

Creating an exceptional customer experience requires treating data as a living, breathing asset, one that needs to be continually updated, improved for accuracy, added on to, and accessed in the customer’s cadence. This approach does not entail a digital transformation; rather, it starts with applying customer data that is centered on the customer vs. applying data around a channel, a process or a functional team. For instance, a marketing team responsible for creating and executing an email campaign will likely only prioritize customer data relevant for a specific campaign or that specific channel; an email invitation to join a loyalty program will broadly segment out an audience of eligible customers, and the campaign will run with built-in incentives for opens and conversions.

All too often, the campaign and the results exist in a vacuum, independent of an individual customer’s journey with a brand. Eligibility for the campaign may have been determined by creating a static list of customers, chosen because they had yet to join a loyalty program or they met an average monthly spend criterion. But a static email fails to account for a contextual understanding of a customer journey – the customer’s interests, other interactions with the brand across different channels, intent or another marker.

A true customer-centric approach begins with a data-centric approach. With a focus on data as an enterprise asset, organizations break through the technology, process, and channel siloes that prevent them from effectively monetizing their customer data.

If the same email campaign is organized around a single customer view, a dynamic segment will produce a smaller group of customers for whom the invitation is hyper-relevant at the time the customer opens the email. It becomes a natural extension of the customer’s journey up to that moment, a next best action. Opens and conversions are then only success metrics in furtherance of a larger enterprise goal such as an increase in lifetime value vs. basing incentives on a team’s performance or the success of any one channel.

Commit to Organizing Your Data Around the Customer

Becoming customer-centric starts with a mindset change. By accepting that bringing together the first-party data that already exists inside your organization is essential to competing on CX, companies start to organize their data and processes around a single customer view.

Once companies have a clear vision and a sustained commitment to putting customer data at the center of business operations, they can gradually introduce more advanced personalization capabilities. With even minor changes in a company’s culture in terms of its approach to data, teams begin to collaborate differently, decisions become more data-driven and customer focus begins to become more instinctive.

A true customer-centric approach begins with a data-centric approach. With a focus on data as an enterprise asset, organizations break through the technology, process, and channel siloes that prevent them from effectively monetizing their customer data.

This culture shift is essentially an enterprise recognition that superior customer experiences transcend marketing. Operationally, a single view of the customer should be viewed as a capability that empowers sales, service delivery, customer service, product teams, and is supported by data science and IT teams. Everyone has a stake in strengthening the brand-customer relationship. This mindset shift is possible without needing to restructure an organization, shortening the time to value.

According to a landmark McKinsey study on personalization, the strength of a relationship a brand builds with a customer and revenue gains are directly related to how a company approaches the collection and use of first-party data. Brands that traditionally operate without a direct customer relationship (e.g., CPG) and thus do not prioritize the collection of first-party data might achieve revenue gains of up to 10 percent through personalization. By contrast, digitally native brands and those for whom first-party data is the heart of decision-making generally have a very strong customer relationship and achieve revenue gains of up to 25 percent.

More advanced personalization correlates to higher revenue gains because experiences are oriented around the customer. In the McKinsey study, 72 percent of customers said they expect the businesses they buy from to recognize them as individuals and know their interests. Asked to define personalization, those same consumers said that it is when brands demonstrate an investment in the relationship, not the transaction, as manifested by positive experiences that makes them feel special.

The stakes are set. As customer engagement technology matures and as capabilities expand, customer expectations continue to rise, and competition to win individual customers intensifies, the ability to consistently deliver personalized experiences at scale will widen the advantage of market leaders over the rest of the pack. The winners will be those who can build the capabilities to constantly transform their customer data into meaningful experiences that add real value to customers’ lives.